Total, both of those the CDC and also the bank lender should be able to impose their unique SBA 504 loan demands to find out whether or not your business is suitable.

Question questions about anything at all you still don’t realize and become all set to proceed to another lender if a thing doesn’t sound right. If the expense of the loan is a lot more than the gain and dealing cash you’ll get from it, you’re greater off in search of different selections.

Small business loans supply working funds for commencing a business, controlling income movement and expansion, and machines invest in or refinancing financial debt.

You'll want to continue to keep your personal credit rating score approximately snuff, since the more recent your business as well as smaller your revenues, the greater lenders will examine your personal funds.

This demo web page is only for demonstration reasons. All pictures are copyrighted for their respective house owners. All content material cited is derived from their respective sources.

Once your business requires to acquire, refinance or increase housing, we provide loans separately tailor-made to your financing demands.

Utilize online in minutes.‡ Any time you hook up your business accounts towards your Business Line of Credit history application, your financial data is reviewed in serious time for an effective final decision.

Business credit score report. Just like a personal credit get more info report, the lender will need you to offer aspects so it may possibly access this report.

So far, if you want more rapidly funding or don’t Imagine you are able to qualify for an SBA 504 loan, you’ll want to check out option resources of financing—like brief-time period loans, business lines of credit, or other types of business loans.

In advance of we dive into the main points, You need to use the data below to have a greater sense of SBA 504 loans, at a glance.

On this website page, you’ll come across an index of several of the optimum-rated lenders inside the business. Consider their opinions, Look at their features, and find the lender that’s most effective suited to satisfy the requires of your respective business.

As soon as you find a bank that will help you, they need to be capable to advocate a CDC that they frequently get the job done with. Alternatively, It's also possible to start out by discovering the CDC. The SBA’s Web site has a CDC finder Resource, plus the CDC really should have the capacity to direct you to a local financial institution.

A business line of credit can open up opportunities and adapt to the unique business demands. You could seek the services of seasonal aid or present signing bonuses to entice major expertise, update equipment or order provides, or stock up on additional inventory when costs are very low. You could potentially also think about using it to sleek out gaps inside your money movement.

Merchant dollars developments are according to your volume of every month charge card profits and so are paid again employing a proportion of each future sale.

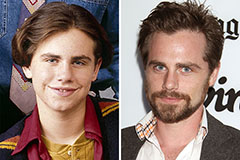

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Joseph Mazzello Then & Now!

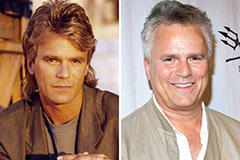

Joseph Mazzello Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!